Our view on what investment markets will look like going forward

We’d like to share what’s on our mind with you. We believe that remaining grounded by the principles of good investing is key as we continue to learn to navigate the difficulties of COVID, lockdowns and what the world will look like as we move forward.

Sharemarkets are up strongly from pandemic induced lows in March 2020

Economic and investment key point summary

- Expect ongoing economic recovery driven by stimulus, vaccines and reopening, albeit with bumps along the way.

- Australian economic growth to contract sharply in the September 2021 quarter with recovery resuming later in 2021 and into 2022. Although “learning to live with COVID” may constrain economic growth initially.

- Spike in headline inflation is likely to be transitory and reflects base effects, higher commodity prices and goods supply bottlenecks. Underlying inflation to remain more constrained beyond this.

- Low global interest rates and tax stimulus to remain, but will start to be gradually unwound.

- Expect the first Reserve Bank of Australia (RBA) rate hike in late 2023 or early 2024.

- Shares likely to see more constrained gains and volatility, but provide good returns on a 12 month view helped by rising company earnings.

- Key risks are inflation, new COVID, manufacturing supply blockages, tensions with China.

Triumph of the optimists

Investing is an exercise in optimism. Every time we purchase an asset, we’re demonstrating confidence in the future. That is, that companies will grow their profits, borrowers will repay their debts and governments will allow capital to move freely around the world. Without optimism, there could be no investment markets or entrepreneurship. However, too much optimism can be dangerous for investors as it can alter our behaviour, leading us to take too much risk without being adequately compensated.

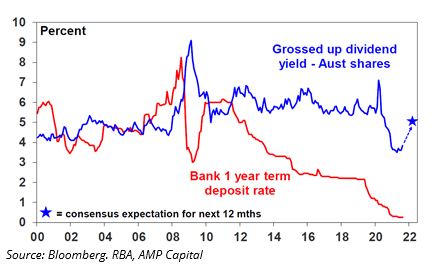

Australian shares offer a very attractive yield versus bank deposits

What we’re looking for, then, is balance. That is, to be neither alarmist nor greedy. On the plus side, we’ve got ultra-low interest rates, high savings rates, surging residential housing prices and an economic recovery – all pointing towards continued demand for growth assets and a reason behind the strong investor interest. But on the downside, it has become apparent that a record number of “new” investors are entering the scene with high expectations of quick gains.

This has been confirmed to us in recent surveys, especially one by UK based asset manager Natixis, who found that investors currently expect a return from equities of 14.5% above inflation (keep in mind, this was a large study of 8,550 people). If we assume long term inflation is 2%, this equates to around 360% over the next 10 years[1]. While such a return is not impossible, the odds are only around 7.35% according to calculations done by research house Morningstar[2]. Even more strikingly, this probability falls to just 0.36% when the starting point is at an all-time high like today (a 1 in 277 chance). Sounds less appealing doesn’t it.

Especially when a new investor doesn’t know if well known companies listed on the ASX are ‘fair value’ or not after they have generally experienced strong growth in the past year. It is important to research whether individual companies have been pushed above their fair values with investors ‘chasing income’ (or dividends and yield) because they are getting very little interest paid on Cash held in the bank (the RBA official cash rate is currently 0.10%); or whether a new investor is drawn to an exciting new tech stock or crypto currency that has never made a profit and who’s share price is currently valued at more than 1000 times it’s proposed earnings.

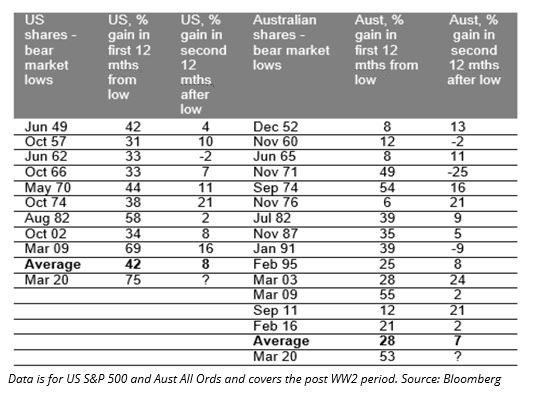

The second 12 months after a sharemarket recovery normally sees lower returns

Monetary Policy and Quantitative Easing (QE)

With interest rates at near zero, the Reserve Bank of Australia has clearly stated they will stick to their current policy of QE (buying Government bonds) at $5 billion a week until February 2022, at which point they will taper down to $4 billion a week for another three months. Given the ongoing lockdowns in Sydney and Melbourne it’s doubtful the Australian economy will have recovered quickly enough for the RBA to have reduced and ceased bond buying before the start of 2023. The RBA has also stated they will not raise interest rates until full employment and sustained wages growth has occurred, which could be some time away.

Elsewhere in the world, the US is continuing to reopen, and the Federal Reserve has signaled that it will start reducing (tapering) it’s bond buying as soon as November and possibly begin to raise interest rates next year. The UK and parts of Europe are following suit. China’s economy has slowed not helped by COVID, property overbuilding and high debt levels, but expect renewed policy easing to drive stronger growth.

Inflation is spiking near term

Sharemarkets don’t like uncertainty, and the threat of inflation will bring concern, periods of volatility and constrained gains compared to the last 18 months. However, base inflation effects are likely to reverse as production and manufacturing recovers from the COVID induced supply chain bottlenecks. On the other hand rising company earnings on the back of economic recovery coming out of COVID are likely to provide good returns on 12 month view.

While the near term spike in inflation is likely to be transitory, the 40 year declining trend in inflation and bond yields looks to have bottomed out. How long bonds bounces along the bottom is unknown and dependent on the rate of economic growth and inflation. Certain types of high quality short duration bonds will still be important diversifiers of risk.

Bond yields have likely seen their lows, expect poor medium term bond returns.

Get advice and utilise market leading research and investment management specialists

The key message from us, in times like today, is that is more important than ever to keep our investing ego at the door. We remain focused on having the smartest minds on our team and investing with conviction, of course, as that is where intelligent gains are made. In truth, we’ve made some very healthy gains and I’m delighted with the progress that has been made for all our clients. Even better, we’re staying true to your risk tolerance and making decisions that are appropriate for your investment timeframes. This is important to us, and we hope to you as well.

So, we’ll continue to cheer gains, but remember that the assessment of ‘risk’ means understanding that more things can happen than what will actually happen. Across history there have been plenty of “life changing” events that derailed unwitting investors. We understand the power of developing a professional plan specific to you, implementing the best financial strategies, assisting you stay on track and achieve financial success as you move through the stages of your life… Our Approach Helps You Make Smarter Financial Decisions – Fintech.

The most powerful force in the universe

To finish off, the chart below highlights an incredible example of the exponential power of ‘compound interest’ over the very long term. $1 invested in 1900 in Australian Cash and left to compound is now worth $242. If invested and left to compound in Australian Bonds it did much better at $1,010. Incredibly, the same $1 left to compound in Australian Shares is now worth $768,822. Albert Einstein knew that compound interest had the potential to change lives. Einstein famously said that compound interest is the most powerful force in the universe. He also said, “Compound interest is the 8th wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

Shares versus bonds & cash over very long term – Australia

We hope you find this helpful. If you would like us to elaborate further, we’d be delighted to chat.

[1] https://www.im.natixis.com/uk/research/2021-natixis-global-survey-of-individual-investors

[2] Morningstar Investment Management calculations, Robert Shiller data, from 1/1/1881 to 31/7/2021.

Featured photo by Tomasz Frankowski on Unsplash

Leave a Reply

Want to join the discussion?Feel free to contribute!