Key points from the 2022-23 Federal Budget

As the post-pandemic economic recovery continues to take shape, Australian Federal Treasurer Josh Frydenberg has handed down the 2022-23 Federal Budget

Among the proposed changes, the Morrison Government has announced a pre-election cash splash and plans for lower budget deficits in the coming years.

The additional spending relates mainly to this calendar year, and given the stronger than expected economy it looks to be more motivated by politics than economics. “Fiscal repair” kicks in for the medium-term but this takes the form of restrained spending growth in contrast to the last two budgets, rather than austerity. Despite this, the Government is able to announce lower budget deficit projections thanks to a windfall from faster growth and higher commodity prices which is resulting in faster tax collections and lower welfare spending.

Key points

- A budget windfall has allowed both more spending and projected lower budget deficits, with the 2022-23 budget deficit expected to be $80bn (down from $99bn in December 2021).

- Key measures include one-off “cost of living” payments, a temporary cut to fuel excise, more spending on infrastructure & defence, more help for home buyers, and the continuation of the 50% reduction in minimum Pension drawdown rates from superannuation.

- Relying mainly on nominal economic growth to reduce the deficit and debt, the Government runs the risk that it could take a very long time to get back to budget surpluses and repay the almost $1 Trillion debt to a reasonable level.

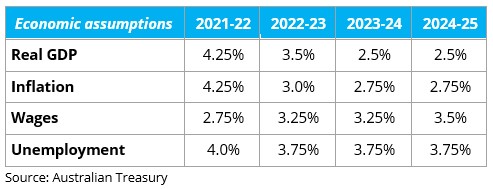

Economic assumptions

- The Government revised up its growth forecasts for this financial year (from 3.75% to 4.25%) and kept 2022-23 GDP growth unchanged at 3.5%.

- Unemployment is expected to fall to 3.75% by June 2023 (down from 4.25%).

- Inflation and wages forecasts have also been revised up significantly.

- Net immigration (estimated to be +41,000 this year rising to +235,000 by 2025-26) becoming more of a growth support.

- The Government pushed out its $US55/tonne iron ore price assumption to September quarter 2022. While iron remains around $US135/tonne, it is a source of revenue upside.

Read on for a round-up of how the proposals might affect your household expenses and financial future.

Remember, many of these proposals could change as legislation passes through parliament.

Superannuation

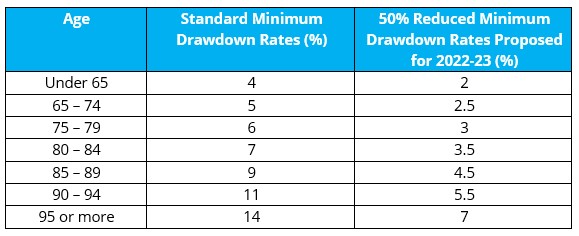

Temporarily extending the minimum Pension drawdown relief

Proposed effective date: 1 July 2022

The temporary reduction to the minimum income drawdown requirement for superannuation Pensions will be further extended until 30 June 2023.

This will allow people to minimise the need to sell down assets given ongoing market volatility. It applies to account-based, transition to retirement and term allocated superannuation Pensions.

For the 2022-23 financial year, the proposed minimum Pension drawdown will be:

Tax

-

Temporarily cutting fuel excise

Proposed effective date: 30 March 2022

Fuel excise will temporarily be cut by half, or 22.1 cents per litre, to save families an estimated $30 a week. This measure will end on 28 September 2022. -

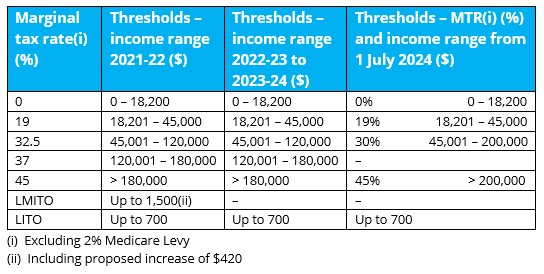

Increasing the Low and Middle Income Tax Offset (LMITO)

Proposed effective date: 1 July 2021

- The LMITO will be increased to up to $1,500 for the 2021-22 financial year. All eligible LMITO recipients will benefit from the full $420 increase, referred to as the Cost of Living Tax Offset.

- The benefit for those earning up to $37,000 will be $675 (currently $255).

- For those earning between $37,000 and $48,000, the offset will increase at the rate of 7.5 cents per $1 above $37,000 to a maximum of $1,500 (currently $1,080).

- Those earning between $48,000 and $90,000 are eligible for the maximum LMITO benefit of $1,500 (currently $1,080).

- For income above $90,000, the offset phases out at a rate of 3 cents per $1 and is not available when taxable income exceeds $126,000.

- The LMITO is due to end on 30 June 2022 and has not been extended.

Personal tax rates, thresholds and offsets

The Low Income Tax Offset (LITO) remains unchanged at $700 and will be reduced at a rate of:

— 5 cents per $1 for income between $37,500 and $45,000, and

— 1.5 cents per $1 for income between $45,000 and $66,667.

Effective tax-free threshold (2021-22) with LMITO and LITO:

— $25,437 for individuals below Age Pension age (some Medicare levy may be payable). -

Increasing the Medicare levy low-income thresholds

Proposed effective date: 1 July 2021

Low-income taxpayers will generally continue to be exempt from paying the Medicare levy.

— Singles will be increased from $23,226 to $23,365

— Families will be increased from $39,167 to $39,402

— Single seniors and pensioners will be increased from $36,705 to $36,925

— Families (seniors and pensioners) will be increased from $51,094 to $51,401.

For each dependent child or student, the family income thresholds increase by a further $3,619.

Social security, families and aged care

-

Introducing a one-off cost of living payment

Proposed effective date: 28 April 2022 onwards

To help with higher cost of living pressures, the Government will provide a one-off tax-free payment of $250 to Australians who receive qualifying social security payments or hold eligible concession cards, including:

— Age Pension

— Disability Support Pension

— Carer Payment

— Carer Allowance Jobseeker Payment

— Pensioner Concession Card holders

— Commonwealth Seniors Health Card holders.An individual can only receive one payment, even if they’re eligible for multiple benefits or concession cards.

-

Enhancing the Paid Parental Leave scheme

Proposed effective date: 1 July 2023

Currently, the Paid Parental Leave scheme is made up of two payments for eligible carers of a newborn or recently adopted child:

— Parental Leave Pay of up to 18 weeks at a rate based on the national minimum wage.

— Dad and Partner Pay of up to 2 weeks at a rate based on the national minimum wage.The Government plans to create a single scheme of up to 20 weeks, fully flexible and shareable for working parents within two years of their child’s birth or adoption. Single parents will also benefit from the extended 20-week entitlement.

The income test will also be broadened. Parents who don’t meet the individual income threshold (currently $151,350) can still qualify for payment if they meet a family income threshold of $350,000 a year.

-

Lowering the Pharmaceutical Benefits Scheme (PBS) threshold

Effective date: 1 July 2022

The Government will reduce the PBS safety net thresholds to support people who have a high demand for prescription medicines due to their health needs.

This means approximately 12 fewer scripts for concessional patients and 2 fewer scripts for general patients a year.

On reaching the PBS safety net, concessional patients will receive their PBS medicines at no cost for the rest of the year, and general patients will pay the concessional co-payment rate (currently $6.80 per prescription).

Housing Affordability

Expanding the Home Guarantee Scheme

Proposed effective date: 1 July 2022 or 1 October 2022 depending on the specific scheme

The Home Guarantee Scheme allows first home buyers to build or purchase a newly built home with a low deposit, replacing the need for commercial lenders’ mortgage insurance.

The Government is expanding the scheme to make available:

- 35,000 guarantees each year (up from the current 10,000) from 1 July 2022 under the First Home Guarantee, to support eligible first homebuyers to build or purchase a newly built home with a deposit as low as 5%.

- 10,000 guarantees each year from 1 October 2022 to 30 June 2025 under a new Regional Home Guarantee, to support eligible homebuyers (including non-first home buyers and permanent residents), to purchase or construct a new home in regional areas with a deposit as low as 5%.

- 5,000 guarantees each year from 1 July 2022 to 30 June 2025 to expand the Family Home Guarantee. This program enables eligible single parents with dependants to enter or re-enter the housing market with a deposit as little as 2%.

Eligible first home buyers may also be able to take advantage of the First Home Super Saver Scheme which allows them to use the concessionally taxed super system to save their first home deposit. Other federal and state grants and stamp duty concessions may also be available.

Assessment and summary

This is very much a pre-election Budget with few direct losers (e.g. tax avoiders) and lots of winners – including low and middle income taxpayers, welfare recipients, motorists, first home buyers, parents with young children, older super members, apprentices, builders, small business owners, defence industries, transport users, tourism operators, and even Koalas.

The Budget has a number of things to commend it:

- Medium term structural spending is no longer being ramped up faster than the economy.

- Most of the budget windfall from stronger growth and higher commodity prices is being put to deficit reduction and hence long-term debt stabilisation (unlike last year when it was mostly spent), and

- The annual addition to infrastructure spending along with measures like the Apprenticeship Incentive Scheme will provide some boost to productive potential.

However, at a micro level the Budget may be criticised on the grounds that:

- The temporary fuel excise reduction is bad economic policy in that, it may be very hard to reverse if oil prices keep rising or stay high, it will make no sense if oil prices fall back on say a Ukraine peace deal, and it sets a bad precedent.

- Many welfare recipients are arguably getting compensated for “cost of living” pressures twice – via the one of payment and via the indexation of payments to inflation, and

- The housing measures continue to focus more on demand than supply which will result in higher than otherwise home prices (even though they are unlikely to prevent the cyclical downturn in prices now starting) and will boost debt levels.

At a macro-economic level there are two big risks flowing from the Budget:

- Firstly, the pre-election cash splash (which is about 1% of GDP in terms of new stimulus in the Budget for this calendar year, but is actually a bit more if spending of the $16bn in “decisions taken but not yet announced” in the Mid-Year Economic and Fiscal Outlook (MYEFO) are allowed for) risks overstimulating the economy at a time when it is already strong, further adding to inflationary pressures and adding to the amount by which the Reserve Bank of Australia (RBA) will have to hike interest rates, and

- Secondly the reliance on growing the economy to reduce the budget deficit and debt is unlikely to reduce debt quickly enough and is dependent on interest rates remaining low relative to economic growth. 10-year bond yields have already gone up more than four-fold since their 2020 low warning of a sharp increase in debt interest payments beyond the medium term. And economic growth is unlikely to be anywhere near strong enough to reduce the debt burden like it did in the post-WW2 period unless there is another immigration boom or 1980s style focus on boosting productivity – both of which look unlikely. In the meantime, the strategy would be highly vulnerable if anything came along to curtail the commodity boom. So at some point tough decisions are likely to be required either to reduce spending as a share of GDP or raise taxes.

Implications for the RBA

It is now likely that the RBA will start raising interest rates in the period June to August 2022, with the cash rate expected to reach 0.75% – 1.00% by year end and 1.50% – 1.75% in 2023. The extra stimulus in the Budget increases the chance that the first rate hike will be 0.40% rather than 0.15% (taking the cash rate to 0.50% after the first increase).

Implications for Australian Assets

- Cash and Term Deposits – Cash returns are poor but they will start to rise as the RBA starts hiking from mid-year.

- Bonds – Ongoing budget deficits add to upwards pressure on Bond yields. Where the rising trend in yields results in capital loss, total Bond returns (income + capital) will remain low for the medium-term.

- Shares – More fiscal stimulus (tax breaks), strong growth and relatively low interest rates all remain supportive of Australian shares. However, rising Bond yields and RBA rate hikes will result in a more constrained and volatile ride.

- Property – More home buyer incentives are unlikely to offset the negative impact of poor affordability and rising mortgage rates in driving a cyclical downturn in home prices.

- The Australian Dollar (AUD) – Strong commodity prices point to more upside.

As always, please contact our office if you would like to discuss any of the above in relation to your specific circumstances.

Leave a Reply

Want to join the discussion?Feel free to contribute!