COVID-19 Temporary Relief for Super and Pension

Keeping you informed during the coronavirus pandemic.

We appreciate that you and your family are dealing with a significant amount of information relating to the global COVID-19 pandemic. As a highly valued client of Fintech Financial Services, we want to share with you important changes to Super and Account Based Pensions (Pensions), and keep you informed.

You will also find the latest updates from us on COVID-19 (Coronavirus) and investment markets on our website at www.fintech.com.au/news

Government measures announced on 22 March

Two important changes to Super and Pensions were announced by the Prime Minister, Scott Morrison and the Federal Treasurer Josh Frydenberg on 22 March 2020. The measures provide temporary relief to those experiencing financial challenges due to the economic impacts relating to the containment of the Coronavirus. This is part of the Government’s Economic Response to the Coronavirus.

We believe that this response is a considered, pragmatic and caring move for a nation under stress. The announcement also reflects the strength of our superannuation system and the fact it was built for the well being and livelihoods of Australians.

The measures include:

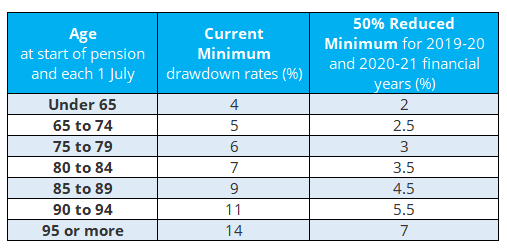

- Reduced minimum Pension drawdown rates for retirees

The Government is temporarily reducing minimum drawdown requirements for Pensions and similar products by 50% for the 2019-2020 and 2020-2021 financial years. - Temporary early access to Super

Eligible individuals in extreme financial stress will be allowed early access to their Super of up to $10,000 before 1 July 2020, and up to a further $10,000 from 1 July 2020. Meaning, if eligible, you may be able to access up to $20,000 overall.

1. Reduced minimum drawdown rates for retirees

The reduction in the minimum drawdown by 50% will provide assistance if you wish to reduce the impact of drawing down on your Super during this time of market crisis and lower investment values. The measures will also assist those who have reduced expense needs during the ‘stay at home’ phase of the Coronavirus, or have access to other sources of cash and income from outside their Super Fund.

Of course for those still able to contribute to Super or who have cash available to invest, the high levels of market volatility are providing extremely attractive long term buying opportunities.

The reduced minimums are now available to everyone with an Account Based Pension, Allocated Pension, Transition To Retirement (TTR) Pension and Term Allocated Pension as per the table below.

Note: The above minimum withdrawal factors are indicative and subject to change by the ATO. The method for calculating the reduced minimum drawdown amount for market linked income streams or Term Allocated Pensions (TAPs) will be different. For more information go to ato.gov.au.

Next steps / action required

Please contact our office by email to or by calling us on telephone 07 3252 7665 if you would like to change your pension payments relating to the periods below:

NB: If you wish to maintain your current Pension arrangements ongoing, you need do nothing more.

a) From Now to 30 June 2020

If you have received monthly Pension payments throughout the financial year, you may wish to cease the remaining months of May and June 2020.

b) From 1 July 2020 to 30 June 2021

You also have the option to reduce your Pension drawdowns by up to 50% of the minimum relating to your Age for the period 1 July 2020 to 30 June 2021, as per the table above.

2. Application for early release of up to $10,000 from Superannuation available from 20 April 2020

The Government has also announced that individuals suffering from extreme financial stress will be allowed early withdrawal of up to $10,000 from their super on compassionate grounds, in each of the 2019-2020 and 2020-2021 financial years, subject to certain eligibility criteria.

For more details on eligibility or to apply for early release, please go to ato.gov.au/coronavirus.

For anyone considering early withdrawal, there are a number of things to consider, including the impact on any insurance held in super, and the fact that withdrawing funds from super will reduce retirement savings.

We are here to provide the best possible advice and financial outcomes for you

Please contact us on 07 3252 7665 if you have any questions about any of the above.

For full details on the Australian Government’s Economic Response to the Coronavirus, visit https://treasury.gov.au/coronavirus.

Please take care of yourself and your family while the Coronavirus runs its course.

Leave a Reply

Want to join the discussion?Feel free to contribute!